London

stocks slips from record high after Greece uncertanity arises which

lead index to fall from all-time highs on Wednesday as investors

scaled back their appetite for risk after a rally the previous

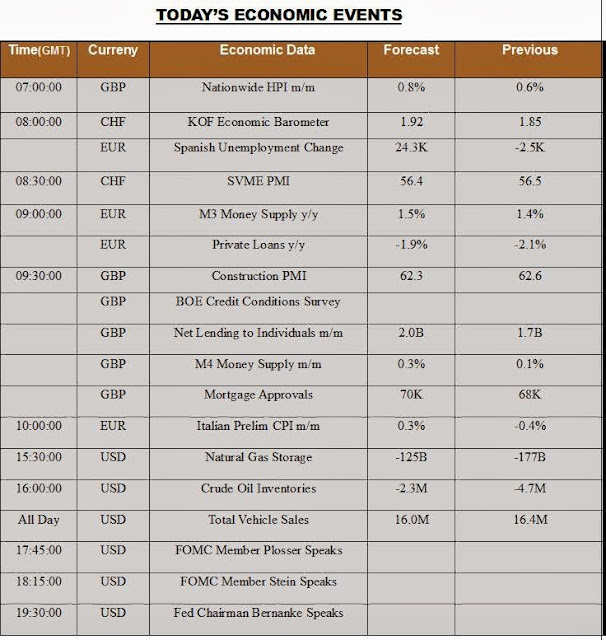

session.In economic data on Wednesday, the British Banker's

Association reported that UK mortgage approvals increased more than

expected in January.

RECOMMENDATION SELL

TARGET 408

The Major trend of Friends Life Group Limited Plc is sideways and

it is showing strength for selling . If it moves below the support

then one can initiate the short position in the stock. If it breaks

the level of 413.50 downside then it can show downside movement for

the target of 408 with the stop loss of 417.80.

CHART FORMATION:-Live chart shows that it is trading near its support and breaking below that support

trendline will lead to selling in the chart. Crossing the support

will lead to downside movement. Stock is trading below the 50 DMA

with negative bias.

CHART FORMATION:-Live chart shows that it is trading near its support and breaking below that support

trendline will lead to selling in the chart. Crossing the support

will lead to downside movement. Stock is trading below the 50 DMA

with negative bias.

INDICATORS:-

RSI is trading near to 44.31 level with negative bias, in upcoming

session downside movement is expected.

MACD and Signal line is sustaining below the zero level line.

To get daily forex signals live chart on your mail register yourself for free trial.

.jpg)