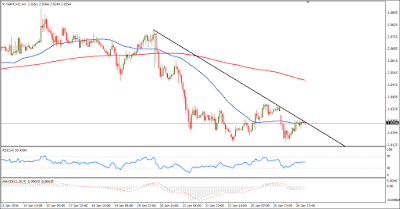

The secondary trend of GBP/CAD is bearish on charts and price is trading below the trend line in its hourly chart. In hourly chart the price is sustaining below 200 day SMA and taking resistance of 50 day SMA indicating downtrend of the pair. It is having an important resistance at the level of 2.0370 and support at the level of 2.0220. If it breaks its support level on the downside and sustains below it then we can expect it to show further bearish movement in the pair.

INDICATORS:-

MACD is sustaining in

its negative territory indicating the bearish trend in the pair.

RSI is sustaining in

its selling zone indicating the upcoming bearish trend in the pair.

STRATEGY:

GBP/CAD is

looking bearish on charts for next few trading session. One can go

for sell on higher level strategy for this pair for intra day to mid

term positions in it.